The Affordable Care Act (ACA) made life just a little more complicated for many of the HR and payroll departments we work with. Which of the new forms will you need to file? How many full-time employees do you really have? What are the fines for failing to provide affordable healthcare coverage? In this article, we’ll show you how answering these (and other) questions and managing ACA reporting requirements is easier than you thought using Sage HRMS.

ACA Simplification Tools

As a Sage customer, you have 2 great options that simplify the complexity of ACA compliance including:

ACA Comply – a web-based application designed to work hand-in-hand with Sage Payroll Services (a hosted payroll solution).

My Workforce Analyzer – a dashboard and analysis tool designed to work with Sage HRMS Payroll (an on-premises payroll solution).

Flexible enough to meet the needs of a variety of employers, both ACA Comply and My Workforce Analyzer rely on integration with your existing Sage Payroll data (on-premises or hosted) to provide the tools, reports, and information you need to comply without entering data twice or managing two separate systems.

While both options may look slightly different from one another, they essentially offer the same set of features designed to minimize tax liability, avoid potential penalties, and simplify ACA compliance reporting.

Features Overview

Here’s a look at the features and benefits included in ACA Comply and My Workforce Analyzer:

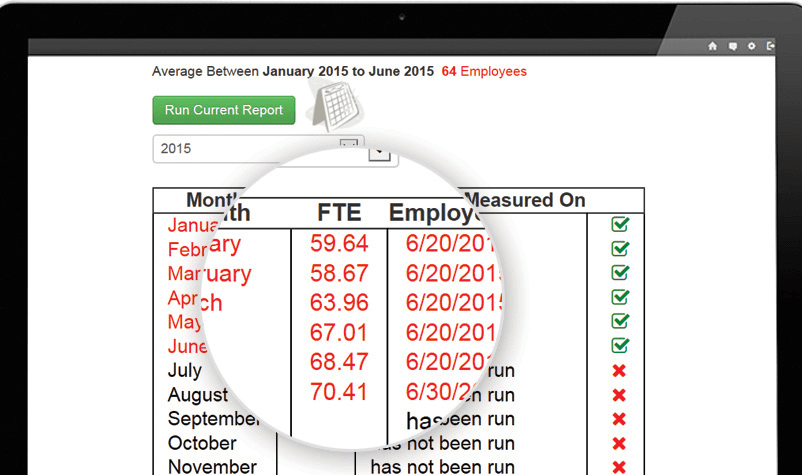

FTE Employee Calculator – Using your existing payroll data, automatically calculate the number of Full-Time Equivalent employees (FTEs) to determine your status as an Applicable Large Employer (ALE).

Employee Info at a Glance – see a summary of ongoing hourly, salaried, and variable hour employees with and without healthcare coverage, including the measurement periods, administrative periods, and stability periods.

Pay or Play Analysis – on-screen reports show comparisons and provide “what-if” modeling options to help determine what makes the most financial sense for your company (purchase insurance or pay the fine).

File with Ease – your forms will be filed for you electronically (ACA Comply only). You also get an option to have the Sage Payroll Services team print and distribute 1095-c copies on your behalf (additional fees apply).

ACA Compliance Made Easy

If ACA compliance requirements have made your life a little more challenging, it may be time to consider a new approach using ACA Comply or My Workforce Analyzer. Get in touch with your account manager to speak with an expert about Sage HRMS.