The new Deltek Vision Asset Management module has been available to 7.5+ users for several months now and it’s about time we wrote an overview.

Historically, assets in Vision have been little more that a line entry in an asset account on the general ledger. Vision Asset Management lets you maintain an info center record for all assets owned by your company. The module gives you have the ability to keep intricate records pertaining to your assets and track transactions for each asset.

Tracking Assets

Tracking Assets

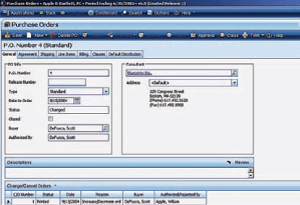

Deltek Vision keeps track of assets in the equipment info center. The equipment info center is common to the Vision Purchasing module and the asset management module stores not only capital assets, but prepaid items. If you own the purchasing module it will also track equipment that would normally be considered a capital asset but is instead charged to a project or projects. Assets can be added to the equipment info center through accounts payable transactions, purchasing transactions or by inserting them directly into the equipment info center.

Processing Transactions

The asset management module allows you to process transactions against the assets you have entered. Transactions types include acquisition and disposal, transfer, amortization of prepaid items and depreciation.

Calculating Depreciation

Depreciation configuration allows you set up an unlimited amount of depreciation methods. You can also configure multiple depreciation “books” which allows you to depreciation your assets in multiple manners for differing taxing authorities. For example, you can depreciate a company owned vehicle straight line for general ledger or GAAP purposes, MACRS for federal tax purposes in your federal tax “book”, and double declining balance for local property tax purposes in your local “book”.

Additional book transactions do not create a GL entry but do track the accumulated depreciation on the info center record. Depreciation can be run manually or scheduled to run on your process server. You can also set section 179 limits on a year by year basis and assign assets to be expenses under section 179. Disposal of assets will create journal entry or cash receipt transactions which remove the asset and the accumulated depreciation for the asset and credit or debit the gain or loss on the disposal.

Summary

The Deltek Vision Asset Management module is a powerful tool that will allow you to track assets within your Deltek Vision application. You will no longer have to track assets using third party software and enter the transactions manually. The transactions created in the asset management module are already within the application and ready to be posted. To request a quote or schedule a personalized demo call your Account Manager at BCS Prosoft today at 800.882.6705 or contact us online