With the worst of the financial crisis behind us the A&E industry continues to inch ahead as a whole. However, this doesn’t mean we’re in the clear just yet. The market is more competitive than ever with firms experiencing more fierce competition and the most innovative firms are using smarter project management techniques to uncover lost profits.

Each year Deltek publishes the Clarity Architecture and Engineering Industry Study to benchmark the financial performance and market outlook for A&E firm leaders. For the 36th edition in 2015 Deltek expanded the study topics to include business development and project management. The key findings from this report are based on 2014 fiscal year data provided by 386 U.S. and Canadian A&E firms.

We previously analyzed this study to define some characteristics of the best run A&E firms, but there’s a ton of thought provoking information in this study and the key takeaways speak for themselves:

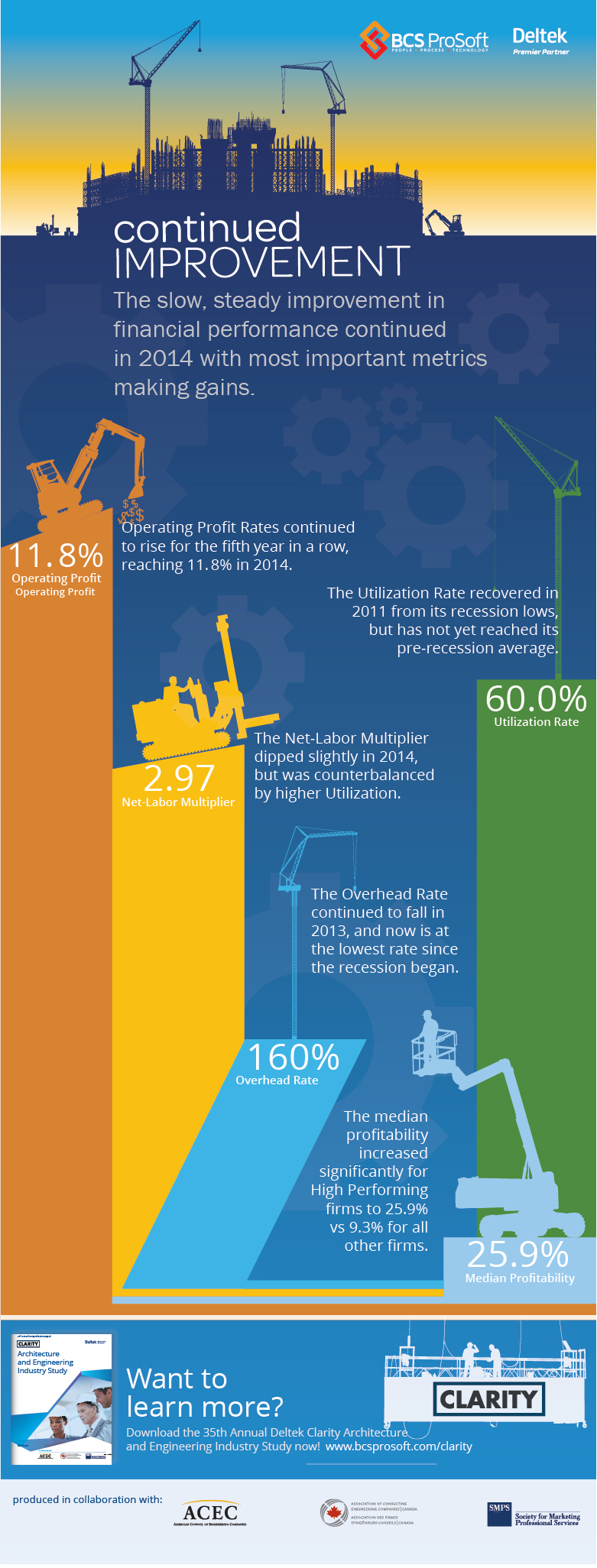

Financial recovery steady, but room for improvement

Almost every A&E financial indicator improved again in 2014, but five years into the current economic recovery, the industry has yet to return to its pre-recession financial strength. To get to the next level, leaders will need to pay attention to financial metrics that still have considerable room for improvement. Most key performance indicators inched ahead in 2014, but the rate of improvement is slowing. Operating Profit rose to 11.8%, the Utilization Rate increased marginally to 60%, and the Overhead Rate dropped to 160%. The Net Labor Multiplier declined slightly to 2.97. In addition to optimizing the traditional KPIs, A&E firms should keep a close eye on the rise in Total Employee Cost, Employee Turnover, and Fixed Asset investments.

Related articles: Top 3 Most Important Balance Sheet Ratios for Professional Services Firms and Top 3 Income Statement KPIs for Professional Services Firms

Firms challenged by competition, limited time for business development

A&E firm leaders are quite optimistic about their prospects in 2015, but will only be able to turn their projections into reality by implementing effective business development strategies and addressing the industry’s greatest business development challenges—competition and limited time. Earlier and better identification of opportunities and strategic networking for teaming are two ways that firms are meeting today’s challenges. Win Rates have increased in the last two years in nearly half of firms. While the “seller-doer” model of business development is alive and well in the A&E industry, use of dedicated business development staff is widespread, especially in large firms. A&E firms believe the Water/Wastewater/Storm Water, Commercial, and Roads & Bridges markets will be the hottest in the coming year.

Related article: Business Development Hurdles for Professional Services Firms

Project management pitfalls point to big bottom-line impacts

For the first time, this year’s Clarity study examined the A&E industry’s best practices in project management, and the results reveal a mixed report card for project data accuracy and visibility and project management maturity. Accurate project cost forecasting (52.3%) and collaboration and communication (47.4%) were the top ranked project management challenges. In the average firm, only 75% of projects were currently on or under budget. Nearly a third of participants said their project management capabilities are somewhat or very immature. The average A&E firm has 37% of its revenue tied up in just three clients.

Related article: Project Management and Positive Impacts on the Bottom Line